Let's imagine that you want to start your own pizza shop. Now starting the pizza shop would require some investment.

For example, you would be investing in equipments, land, furniture, food supplies etc. All the money that you invest to start your pizza shop business is called as capital. Let's say, you would be requiring the investment of $2000 in order to start your pizza shop business.

But what will happen if you do not have the investment of $2000 in order to start your pizza shop? In that situation, you have 2 options.

You would take a loan from somebody that need to be paid with interest. Or,

Issue stock (or share the ownership in the company) to people who may be willing to invest in your pizza shop in return for a proportional share of profits that your pizza generate.

Okay, let's take both the situations one-by-one and find out the advantages and disadvantages with them.

Disadvantages

It is not very easy to take loan. In our example, if we want to take loan from anybody, then the first thing we would be doing is to convince the person that his money is safe and we will be able to return his money back. The person who is giving us loan would certainly be interested in knowing about the future plans of the business and lot more things.

Next, we will have to return all the money that we have taken as a loan with interest. This interest would increase as the time passes. The more time we take to repay the principal amount, the more interest we would be paying.

Advantages

You do not have to share the ownership of the company.

Issuing Stocks

Advantages

A company can raise more money than it can borrow.

You do not have to make periodic interest payments to your creditors.

And you do not have to make the principal payments.

Disadvantages

You have to share your ownership with the other shareholders

Your shareholders have the voice in company’s policies that affects the company operation.

So we can say that...

Companies sell stock (pieces of ownership) to raise money and provide funding for the expansion and growth of the business. The business founders give up part of their ownership in exchange for this needed cash.

The total number of shares will vary from one company to another, as each makes its own choice about how many pieces of ownership to divide the corporation into.

One corporation may have only 2,500 shares, while another may issue over a billion shares such as IBM and Ford Motor Company.

Adbrite Ads

As a trader, have you had occasions when you just could not pull the trigger and afterward you were mad at yourself?

Have there been times when, as soon as you pulled the trigger, you started doubting yourself?

You are not alone. There are a lot of traders who go through this.

Studies have shown that when traders consistently do not succeed, it's not because they aren't smart, don't work hard or aren't lucky. It's because they simply don't understand how successful trading works.

There are different factors contributing to not being as successful as you want to be.

One factor might be that it is a new market for you and you do not have enough experience in how to deal with this market.

Another reason might be that at one point, you lost a great deal of money. You might be afraid of making the same mistakes.

Thirdly, it might be that your personality traits are not a match for the markets, systems or mentors that you are following.

The fourth reason is that you might be afraid of losing money, period. If you are in this category, then trading is not the right business for you. In trading, you will lose money. The challenge is how to cut losses faster and how to let winners run longer.

If you are in the first three categories, there are 8 steps that you can take to enable you to confidently pull the trigger and have more wins.

1. Be prepared. When selecting a market, select one that matches your personality.

You all have heard the saying that “people do not change.” The fact is that it is very tough for us to change. Instead of trying to change who you are, why don’t you adopt a market that fits your personality traits?

You really have to prepare yourself technically and emotionally. Learn the skills that you need to trade the markets. Select the systems that match who you are.

2. Limit your input. Whatever markets you are watching or news you are listening to, you’ve got to limit your input. You cannot listen to all of the information and do everything. Your brain cannot absorb it all. It overloads and just shuts down. You may have heard the saying “a confused mind does not make a decision.” You’ve got to limit your input.

3. Trust Yourself. Once you have done your research, chosen the trading methodology, trading system and trading mentors that match your personality, and you have a gut feeling, trust it.

When in a study asking top CEO’s what had made them successful, do you know what their responses were? It was their gut feeling. They followed what they believed was the right thing to do.

4. Take Action. I know this sounds obvious. However, I have seen people who have studied and paper traded for about 18 months. They have headed investment clubs and talked about strategies, yet they still have not pulled the trigger.

You just have to do it. Nothing replaces the actual experience. You can start very small. Only invest the money that you can afford to lose. Think about it as the cost of education.

We are not defined by our abilities. We are defined by our choices. What are you willing to choose?

5. Be Present. What do you do when a trade goes against you? How do you react? Do you get angry? Do you blame yourself? Do you go into denial? What happens to you?

Are you missing opportunities? Are you overtrading?

This is the time to use the pause method. Take a break. Do not make any decisions. Step back. Change your focus. Where you focus, you’ll spend your energy and that will create results.

Look at the market objectively and concentrate on the next deal. Think of each trade as an individual deal. Evaluate it by using your system and make a decision based on your rules.

Think about basketball players. They cannot concentrate on the shot they did or did not make. They have to look ahead to their next game and next opportunity.

6. Be Resilient. At the end of each day, look at what worked and what did not work.

* Did you follow your system?

* Were you self-disciplined?

* Were you reactive or proactive?

* Did you play to lose, or play to win?

This is a good time to set your strategy for the next day. What can you do differently tomorrow? Forget the losses, but not the lessons. Create contingency plans.

7. Celebrate for taking action. If you had an up day, that’s great! If you did not, celebrate even harder.

When you get mad at yourself, you tend to retreat into your shell. When you celebrate, you acknowledge taking action. You give yourself permission to go forward.

On a constant basis, we are constantly bombarded by “stock trading tips”, in emails, by regular mail, and in many other forms of print. We’ve all seen those nice glossy newsletters in our mailbox proclaiming the next hot stock that is “Going to Quadruple Your Money in Only Six Weeks”, and other similar ridiculous claims.

Most of these stock trading tips are worthless and will only end up causing you to lose money or break even at best. But, how do you determine if these stock market trading tips that are being freely given have any real value or not?

Luckily, there are a few basic guidelines you can follow that will help you to determine if these tips are going to have a likely chance of improving the value of your stock trading portfolio. Follow these few simple guidelines listed here and you’ll be able to eliminate most, if not all of the “stock trading tips” you receive.

Guidelines to Determine Whether Stock Trading Tips Have Real Value

1) Who is paying to have these tips delivered? A lot of what you receive are simply paid advertisements. Look closely at the bottom of the last page. By law, if a company has been paid to promote a stock, they must state this fact. And usually it is in small print at the bottom or end of the document. If it says they were paid to promote the endorsed company, you can usually bet that you will NOT “get paid” by investing in it.

2) Check the recent volume of the underlying stock tip. If there was significantly higher recent volume surges before the stock tip was sent out, you can usually rest assured that someone (the people providing the stock tip) have already purchased this stock and hope to make a profit when those that receive their “tips” purchase this same stock from them at an elevated price due to the frenzied buying of their duped targets (you).

3) Search for recent information and news on the recommended tip. If you can’t find out anything about the “great” company they are recommending, then you should strongly consider staying far away from it.

4) Do the providers of these stock trading tips make statements like “largest off-shore oil find ever” or “so profitable they don’t know what to do with all the extra cash”? If so, you should be able to research these stocks and find at least something that backs up these outlandish claims. If not, well, then once again it is probable that you are being misled.

So next time you receive yet another hot stock tip, simply follow the above guidelines to help determine the validity of the investment. You will find that a large proportion of all the free stock tips you receive will meet one of the guidelines above.

Remember, these stock market tips are being given to you for “free”, and more than likely you’re getting what you paid for.

Buyer beware!

Market Capitalization

A company's market capitalization (or "market cap") is calculated by taking the number of outstanding shares of stock multiplied by the current price-per-share. It is the amount of money you would have to pay if you bought every share of stock in a company.

The price that an investor pays for a security. This price is important, as it is the main component in calculating the returns achieved by the investor.

For example, if an investor buys XYZ at $35, then this would be the purchase price. When looking at the return on the investment, the investor would compare the purchase price of $35 to the price the investment was sold at or the current market price for XYZ.

Share

Certificates representing ownership in a corporation. Shares are also known as stocks or equities.

P/E Ratio

The P/E ratio is how much money you are paying for $1 of the company's earnings. If a company were currently trading at a P/E of 20, an investor would be paying $20 for $1 of earnings.

The P/E looks at the relationship between the stock price and the company's earnings. You calculate the P/E by taking the share price and dividing it by the company's EPS.

In other words, if a company is reporting a profit of $2 per share, and the stock is selling for $20 per share, the P/E ratio is 10 because you are paying ten-times earnings

[$20 per share dividend by $2 per share earnings = 10]

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E.

However, the P/E ratio doesn't tell us the whole story itself. It's usually more useful to compare the P/E ratios of one company to other companies in the same industry, or to the market in general, or against the company's own historical P/E.

It would not be useful for investors using the P/E ratio as a basis for their investment to compare the P/E of a technology company (high P/E) to a utility company (low P/E) as each industry has much different growth prospects.

Price / Earnings To Growth - PEG Ratio

A ratio used to determine a stock's value while taking into account earnings growth. The calculation is as follows:

PEG Ratio = Price to Earnings ratio / Annual EPS Growth

PEG is a widely used indicator of a stock's potential value. It is favored by many over the price/earnings ratio because it also accounts for growth. Similar to the P/E ratio, a lower PEG means that the stock is more undervalued.

Keep in mind that the numbers used are projected and, therefore, can be less accurate. Also, there are many variations using earnings from different time periods (i.e. 1 year vs. 5 year). Be sure to know the exact definition your source is using.

Short Selling

The selling of a security that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short sellers assume that they will be able to buy the stock at a lower amount than the price at which they sold short.

Economics. Double ugh! No, you aren’t required to understand “the inelasticity of demand aggregates” or “marginal utility”. But a working knowledge of basic economics is crucial to your success and proficiency as a stock investor. The stock market and the economy are joined at the hip. The good (or bad) things that happen to one have a direct effect on the other.

Getting the hang of the basic concepts

Alas, many investors get lost on basic economic concepts (as do some so called experts that you see on television). I owe my personal investing success to my status as a student of economics. Understanding basic economics helped me (and will help you) filter the financial news to separate relevant information from the irrelevant in order to make better investment decisions.

Be aware of these important economic concepts:

Supply and demand:

How can anyone possibly think about economics without thinking of the ageless concept of supply and demand? Supply and demand can be simply stated as the relationship between what’s available (the supply) and what people want and are willing to pay for (the demand). This equation is the main engine of economic activity and is extremely important for your stock investing analysis and decision-making process. I mean, do you really want to buy stock in a company that makes elephant-foot umbrella stands if you find out that the company has an oversupply and nobody wants to buy them anyway?

Cause and effect:

If you pick up a prominent news report and read, “Companies in the table industry are expecting plummeting sales,” do you rush out and invest in companies that sell chairs or manufacture tablecloths? Considering cause and effect is an exercise in logical thinking, and believe you me, logic is a major component of sound economic thought.

When you read business news, play it out in your mind. What good (or bad) can logically be expected given a certain event or situation? If you’re looking for an effect, you also want to understand the cause.

Here are some typical events that can cause a stock’s price to rise:

- Positive news reports about a company: The news may report that a company is enjoying success with increased sales or a new product.

- Positive news reports about a company’s industry: The media may be highlighting that the industry is poised to do well

- Positive news reports about a company’s customers: Maybe your company is in industry A, but its customers are in industry B. If you see good news about industry B, that may be good news for your stock.

- Negative news reports about a company’s competitors: If they are in trouble, their customers may seek alternatives to buy from, including your company.

Economic effects from government actions:

Political and governmental actions have economic consequences. As a matter of fact, nothing has a greater effect on investing and economics than government. Government actions usually manifest themselves as taxes, laws, or regulations. They also can take on a more ominous appearance, such as war or the threat of war. Government can willfully (or even accidentally) cause a company to go bankrupt, disrupt an entire industry, or even cause a depression. It controls the money supply, credit, and all public securities markets.

What happens to the elephant-foot, umbrella stand industry if the government passes a 50 percent sales tax for that industry? Such a sales tax certainly makes a product uneconomical and encourages consumers to seek alternatives to elephant-foot umbrella stands. It may even boost sales for the wastepaper basket industry.

Your investing style isn’t a blue-jeans-versus-three-piece-suit debate. It refers to your approach to stock investing. Do you want to be conservative or aggressive? Would you rather be the tortoise or the hare? Your investment personality greatly depends on your purpose and the term over which you’re planning to invest. The following sections outline the two most general investment styles.

Conservative investing

Conservative investing means that you put your money in something proven, tried, and true. You invest your money in safe and secure places, such as banks and government-backed securities. But how does that apply to stocks?

Conservative stock investors want to place their money in companies that have exhibited some of the following qualities:

- Proven performance: You want companies that have shown increasing sales and earnings year after year. You don’t demand anything spectacular, just a strong and steady performance.

- Market size: Companies should be large-cap (short for large capitalization). In other words, they should have a market value exceeding $10 billion. Conservative investors surmise that bigger is safer.

- Market leadership: Companies should be leaders in their industries.

- Perceived staying power: You want companies with the financial clout and market position to weather uncertain market and economic conditions. It shouldn’t matter what happens in the economy or who gets elected.

As a conservative investor, you don’t mind if the companies’ share prices jump (who would?), but you’re more concerned with steady growth over the long term.

Aggressive investing

Aggressive investors can plan long term or look only over the intermediate term, but in any case, they want stocks that resemble jack rabbits they show the potential to break out of the pack.

Aggressive stock investors want to invest their money in companies that have exhibited some of the following qualities:

- Great potential: The company must have superior goods, services, ideas, or ways of doing business compared to the competition.

- Capital gains possibility: You don’t even consider dividends. If anything, you dislike dividends. You feel that the money that would’ve been dispensed in dividend form is better reinvested in the company. This, in turn, can spur greater growth.

- Innovation: Companies should have technologies, ideas, or innovative methods that make them stand apart from other companies.

Aggressive investors usually seek out small capitalization stocks, known as small-caps, because they have plenty of potential for growth. Take the tree example, for instance: A giant redwood may be strong, but it may not grow much more, whereas a brand-new sapling has plenty of growth to look forward to. Why invest in stodgy, big companies when you can invest in smaller enterprises that may become the leaders of tomorrow? Aggressive investors have no problem investing in obscure companies because they hope that such companies will become another IBM or McDonald’s.

Using Technical Analysis To Manage Risk And Maintain Top Quartile Performance

Posted by Waqas at 5:12 PMRecent market reversals brought about by the Sub-Prime mortgage melt down is clearly a significant market correcting event. No matter if you work in the risk department of a large bank with many employees or a small fund of funds as co-manager, you share the same basic concerns regarding the management of your portfolio(s).

1. how to maintain top quartile performance;

2. how to protect assets in times of economic uncertainty;

3. how to expand business reputation to attract new client assets;

It remains common in the financial industry to hear experienced Portfolio Managers state their risk management program consists of timing the market using their superior asset picking skills. When questioned a little further it becomes apparent that some confusion exists when it comes to hedging and the use of derivatives as a risk management tool.

Risk management analysis can certainly be an intensive process for institutions like banks or insurance companies who tend to have many diverse divisions each with differing mandates and ability to add to the profit center of the parent company. However, not all companies are this complex. While hedge funds and pension plans can have a large asset base, they tend to be straight forward in the determination of risk.

While Value-at-Risk commonly known as VaR goes back many years, it was not until 1994 when J.P. Morgan bank developed its RiskMetrics model that VaR became a staple for financial institutions to measure their risk exposure. In its simplest terms, VaR measures the potential loss of a portfolio over a given time horizon, usually 1 day or 1 week, and determines the likelihood and magnitude of an adverse market movement. Thus, if the VaR on an asset determines a loss of $10 million at a one-week, 95% confidence level, then there is a 5% chance the value of the portfolio will drop more than $10 million over any given week in the year. The drawback of VaR is its inability to determine how much of a loss greater than $10 million will occur. This does not reduce its effectiveness as a critical risk measurement tool.

A sound risk management strategy must be integrated with the derivatives trading department. Now that the Portfolio Manager is aware of the risk he faces, he must implement some form of risk reducing strategy to reduce the likelihood of an unexpected market or economic event from reducing his portfolio value by $10 million or more. 3 options are available.

1. Do nothing - This will not look favourable to investors when their investment suffers a loss. Reputation suffers and a net draw down of assets will likely result;

2. Sell $10 million of the portfolio - Cash is dead money. Not good for returns in the event the market correcting event does not occur for several years. Being overly cautious keeps a good Portfolio Manger from achieving top quartile status;

3. Hedge - This is believed by all of the worlds largest and most sophisticated financial institutions to be the answer.

Let's examine how it's done.

Hedging is really very simple, and once you understand the concept, the mechanics will astound you in their simplicity. Let's examine a $100 million equity portfolio that tracks the S&P 500 and a VaR calculation of $10 million. An experienced CTA will recommend the Portfolio Manager sell short $10 million S&P 500 index futures on the Futures exchange. Now if the portfolio losses $10 million the hedge will gain $10 million. The net result is zero loss.

Some critics will argue the market correcting event may not happen for many years and the result of the loss from the hedge will adversely affect returns. While true, there is an answer to this problem which is hotly debated. After all, the whole purpose of implementing a hedge is because of the inability to accurately predict the timing of these significant market correcting events. The answer is the use of technical analysis to assist in the placement of buy and sell orders for your hedge.

Technical analysis has the ability to remove emotional decisions from trading. It also provides the trader with an unbiased view of recent events and trends as well as longer term events and trends. For example, a head and shoulders formation or a double top will indicate an important rally may be coming to an end with an imminent correction to follow. While timing may be in dispute, there is no question a full hedge is warranted. Reaching a major support level might warrant the unwinding of 30% of the hedge with the expectation of a pull back. A rounding bottom formation should indicate the removal of the hedge in its entirety while awaiting the commencement of a major rally.

It is evident that significant market correcting events occur infrequently, in the neighbourhood of every 10 to 15 years. Yet many minor corrections and pullbacks can seriously damage returns, fund performance and reputation.

If you have ever been confronted with upcoming quarterly earnings or a topping formation which has caused you to consider liquidation then you should have first considered a hedge used in conjunction with the evidence from a well thought out analysis of technical indicators. Together they are a powerful tool, but only for those who have the insight to consider asset protection as important as big returns. I guarantee your competition understands and so does your clients who are becoming more sophisticated each year. It's important that you do too.

Most of the people are aware of importance of estate planning. And if you have already a will and want to reform that, it may be much troublesome to plan your estate. If you don’t have an estate plan, your state’s law decides who is going to get your assets.

Aouther By : Malik Waqas - BMW

When perusing the wealth of information that runs rampant across and throughout the Internet, one is inundated with a plethora of information about topics that range far and wide, but how does one decipher the mountainous terrain and a million blog posts from people all qualifying themselves as professionals? In the mortgage industry, fraud has amuck in recent years as the housing crisis deepened and homeowners began more desperate.

I was struck in amazement the other day when surfing the Internet for basic information about mortgage-backed securities and refinancing options. What I came across more often than not was not information but mis-information all disguised as truth and fact. I found myself, a seasoned veteran of the mortgage and real estate profession, actually becoming confused from all of the statements of fact and ideas that are filtering through the search engines and blogs and articles.

So I began to ask myself, ‘If I can be confused by it all, how does a homeowner or someone looking to buy a home even begin to make sense of it all?’ It became my mission for that day, and for as long as it might take, to find some answer to this seemingly unsolvable riddle. For now, I will put the question out to my colleagues in the business. What is the best way to steer clients and potential customers in the right direction and away from the poor or deceptive information that waits out there on the ‘Information Superhighway?’

The answer, I believe, is not one that is readily acted upon nor is it a single fixed solution but rather an evolving, growing concept that requires the entire industry to take hold of and shape and help grow. That answer is one of top-down education.

Mortgage refinancing options are some of the top results in the search engines when you seek out information on mortgages. Add the word ‘information’ or ‘article’ to the search and you will immediately be directed to any number of unregulated sites that will post whatever someone wants to write about. Reading through some of these articles and a homeowner could very well become fearful of making the wrong decision, worried that taking their time will cost them not only their home but also their good credit rating.

There was a time when debt and bankruptcy were dreaded words. There was a clear class divide between haves and haves not. Only cash-rich could buy and spend money. Those in dire need of money had to approach the usurers, who gleefully charged exorbitant interest. Indeed, there were special debtors’ prisons in the 19th century in many parts of the world for those failing to pay a debt.

As far as financing is concerned, those were the unorganized days. In many developing countries, private lenders still carry on usurious practices in absence of laws and regulations. Most of the modern economies, however, have a highly regularized system of public and private lending. If earlier the lenders were wary of lending without collateral, today they are more than willing, in fact inviting, to provide both secured and unsecured loans.

Today, there are a number of options open for a borrower. The example of secured loan is a mortgage and that of unsecured loan is the ubiquitous credit card. However, credit cards carry a very high interest rate and fees in case of default, besides tarnishing the credit rating of the cardholder.

So how should one borrow without the pangs of paying high interest and sleepless nights? Taking low interest personal loans is the best option. Many loan services providers offer loans for personal and business purposes. One can borrow any amount from such institutions on easy terms and flexible short-term or long-term repayment options. Whether one requires a small amount (buying a computer, for example) or a large one to buy a new house, loan services providers usually cater to all needs.

Also called signature loans, these are unsecured personal loans often used for financing one’s immediate or future needs. Examples include minor or major purchases, business expansion, home improvement, holiday, children’s tuition fees, or even paying off existing debts (for example, personal loans for debt consolidation or personal loans for bad credit).

The major users of personal loans are those mired in the debt trap by credit card companies and predatory lenders. One can avail of personal bad credit loan or debt consolidation loans for bad credit to reduce their monthly outgoings or to pay off the debts completely. One should, therefore bear in mind that instead of paying hefty interest and charges it is better to consolidate the existing debts by taking low interest personal loans and clear the bad credit history.

After the new bankruptcy law went into effect in October of 2005, many people were under the impression that bankruptcy relief was no longer available or too hard to obtain. Nothing could be further from the truth.

Bankruptcy is great way for hard working people who are facing difficult times to obtain a “fresh start” and rebuild their future. These days bankruptcy filings are rising at unprecedented rates, as millions of Americans have been faced with the loss of a job, unexpected injuries and chronic medical conditions resulting in insurmountable medical bills, or other circumstances that are beyond their control. No matter the situation, people who find themselves deep in debt need some relief and filing bankruptcy continues to be a legal, safe and affordable way to start over.

Bankruptcy can happen to anyone. People in every socioeconomic bracket face unexpected challenges in life. In fact, this year it is expected that over 1,500,000 Americans will seek relief under the bankruptcy code and begin to rebuild their future. Filing for bankruptcy doesn’t make you a bad person, It simply means you have had some bad luck. But before you file, it is extremely important for you to completely assess your situation and make sure that bankruptcy is the best available option to improve your situation.

There are many immediate advantages to filing relief under the Bankruptcy Code. First, there is the relief of the debt itself and the stress related to the collection of the debt. A bankruptcy case results in a “Discharge” of your debts. This means you are not legally obligated to pay them any longer. Debts that can be discharged include, but are not limited to, credit cards, medical bills, unsecured loans, judgments, and certain types of taxes. In some bankruptcy cases you can actually reorganize your mortgage and car loans, taxes and others types of debts that may not be discharged. The nice thing about this is that the court supervises the plan and the creditors have to participate – they do not get a choice.

The second major benefit of filing for bankruptcy is the automatic stay. This means that creditors are barred from calling and harassing you in order to collect debt. The automatic stay also halts lawsuits, prevents garnishments,averts repossessions of vehicles, and stops foreclosures and IRS seizures. Furthermore, if a bankruptcy case is filed before a state court enters a judgment of possession, you can also prevent eviction from a past-due, mortgaged house. You can also prevent your driver’s license from being yanked for any number of unpaid fines.

If you are seriously considering bankruptcy and you live in California, you need to consult with a California bankruptcy lawyer. While the process is complicated, they will be able to help you understand your options and help you avoid making bad decisions that you could later regret. If you are over-burdened with bills and cannot see any light at the end of the tunnel , bankruptcy may be the best option to help you get that much needed fresh start and allow you to rebuild your future.The law offices of Borowitz, Lozano and Clark, LLP specialize in California bankruptcy and exclusively represent debtors in Consumer and Small Business Bankruptcies. They have helped over 20,000 families get free from the burden of debt since 1997. Call today for a free debt consultation at 1-800-509-3200.

Whether it be borrowing from a family member, a friend or a money lender. Borrowing cash can also be an embarrassing affair. Especially when you do not want the reason for borrowing to be known. Usually while applying for a loan, you need considerable amount of documentation and proof. You also need good credit scores, and any arrears or defaults in your financial history can make it impossible for you to get a loan. Applying for a loan and getting rejected is an even bigger embarrassment, since for the application you would have required people to help you submit all those documents. If banks reject your loan applications on account of bad credit history, or if you do not want the hassle of having a loan over your head for a long duration, then payday loans are your best option.

Anyone who is a resident of the UK, is 18 years of age or above, has a regular job, a bank account and a valid debit card can get a payday loan instantly by applying online. All you have to do is fill a simple application form for online loans, which takes about 2 minutes of your time. Payday loans are a cash advance paid against your paycheck. Against here is not meant as a collateral, unlike in secured loans where you have to usually pledge property. Against here, essentially means you are borrowing from yourself, your own pay check in advance, and you can return it back when your actual pay check arrives. Only online loans give you that kind of freedom.

Availing payday loans in the UK has a slight advantage, as rollovers are permitted in the UK. Though it is advised that you do not go in for rollovers, if in the worst-case scenario you are not able to repay the loan with your next paycheck, then you should contact your payday loan lender and ask for a payment option that involves installments. Online loans help you in the time of immediate-cash need. Banks and other moneylenders, lenders who give secured loans, are checklist driven lenders. They usually have a long checklist of 'must have' documents that an applicant must have in order to apply for a loan. Even after you submit all your documents, they leave you waiting around for days together for a reply. While online loans and online lenders will notify you of your loan approval or rejection within a few hours time. Some amount of planning is always required in managing your finances. Even when you get a payday loan, you should be prepared and be able to repay it at the earliest and not get into debt.

Everything is undecided and you cannot imagine about tomorrow. Monetary crisis can occur any time of the month and it becomes more difficult for you when you are not getting quick money at the time of necessity. In these critical situations the only option left is to go for a loan service. No fax payday loans are designed especially for salaried people of UK so that they can obtain finance before their payday as well.

These loans are quick facility because there is no need to arrange the documents and send to the lender. In the absence of verifying procedure, lenders give you cash within 24 hours and you also do not need to search old papers for the loan.

These loans can be borrowed for a period of 1 to 30 days. At the next payday you have to repay the loan. Generally an amount of ₤50 to ₤1500 is allowed to the borrowers on the basis of the income status and requirement.

Now there are some guidelines or conditions that you have to qualify for the approval and the following conditions are:

• The applicant must be permanent citizen of UK.

• The borrower should be 18 years old or above.

• He/she must have fixed income source.

• He/she should hold an active bank account.

No fax payday loans are costly loans because of short-term nature. Lenders charge higher interest rates that you have to suffer little bit. There is no collateral requirement so tenants and non homeowners are welcome for this cash facility.

Bad credit borrowers can apply for this option without any hassle. Lenders also allow the finance to people who have the credit history like default, late payment, CCJs, IVA, bankruptcy, etc.

Borrowers can apply online at their comfort whenever they wish for. Lenders have their official websites where you can apply just by filling out the simple application form.

Forex is the acronym of Foreign Exchange. FOREX has now become one the most prolific areas of investment when it comes to currency trading. Moreover it denotes the exchange of one country’s money or currency with other country.

As currency trading is the biggest market of investment in the world but the trading needs a lot of understanding. The person must have a thorough analysis of market and a strong sense to judge the potential value of a currency. Most importantly, a successful trader or Forex Broker must have the capability to interpret different Forex trade signals.

Here, the exchange is basically done between the banks, non-banking corporations, private investors and speculators.

There are many nations which have their own national currency such as the US dollar, the UK pound e.t.c and also it is very much necessary for them to make payments for importing goods and services from other country's borders. So with the increase in trading with one another, foreign currency is required to pay for cross-border import-export of goods and services. This complies that there must be some mechanism which should be drawn in order to provide access to foreign currencies, so that payments can be made in a form that is acceptable to the seller, and thus this leads to the need for a foreign exchange market for trading foreign currency.

Forex over the counter trading involves substantial risk of loss and is not suitable for all investors. Using leverage in foreign exchange trading may lead to a loss in excess of margin or deposits; therefore, do not invest money you cannot afford to lose. Past performance is not necessarily indicative of future results. You should be aware of all risks associated with foreign exchange trading.

However, in that case, the person is only dealing with the counter currency. Thus in the currency markets, one currency is valued against another and consequently, a rate of worth can be found out. The reason of this is the fact that the value of the currency of a country is always relative and it can not be measured without comparing it to the currency of the other countries.

Also, one should keep it in mind that If price reached a peak some days ago and has since retraced, that level that was reached becomes a key level of resistance. If you enter a trade anywhere near that level, understand that it will take major buying pressure to get price above that level.Conversely, if price fell to a deep low within the last week or few days, for price to continue on down there is going to have to be intense selling pressure to pass that level which has now become support.

The FOREX is the largest financial market in a globe. The Foreign exchange trading is the most liquid financial marketplace for currency exchange. It also refers to denomination of money in the currency of another nation or simply it comprises of trading foreign currency between the nations. So the person who exchanges money in his own nation’s currency for money of other nation’s currency acquires foreign exchange.

The fundamental Forex trading method takes all aspects of the country in which the currency is traded into account. Foreign exchange can be in any form like cash, funds available on credit cards and debit cards, traveler’s checks, bank deposits, or other short-term claims. So now we can say that the foreign currency exchange is the biggest business in the world. And no other market can compete the global size of FX market.

Now Technical Forex market analysis should be done before trading. Things such as the economy, the countries prime interest rates, war, poverty level, and other factors which should be taken in to account. If there is a sharp rise in the prime interest rate a Forex trader or Forex broker should take a position based on that information. Having a few good trading methods on hand will give you a platform to launch your strategies from and rationalize some investment decisions based on some tried and true principles.

The good perspective point in trading is to read the value of other currencies pretty easily. The US dollar is perhaps said to be one of the most popular currencies traded in the FX market and it is a feature in almost every major currency pair out there and it is also often quoted in financial reports and speculations on markets and systems. So it is a good idea to convert all your assets into US dollars.

A good trading method is to make a decision based on economic and market factors values and data begotten from technical and fundamental analysis. There is no hit and hope methodology for trading in the Forex market. You need as much information about the country’s currency and the situations in and out of the state for you to make an informed investment decision.

One of the crucial components of trading forex signal is the proper money management system. It is a major and very important element of forex trading. Profits cannot be achieved and sustained without one. Basic purpose of money management system is to protect trading account from excessive losses and to preserve profits. The proper money management is absolutely necessary and any trading activity will have no future without one.

This aspect of speculative forex signal trading is tightly connected with trader’s psychological approach to trading. Any devotions from it would be an indicator of typical human’s emotions as greed or lack of discipline which are the main reasons for failure in this field. Not having money management system in place would effect in damaging the trading account to such a point that it would be impossible to bring it back to good shape again or totally destroying it.

As we know the trading forex signal can be very unpredictable task especially in current difficult market conditions. It is down to proper techniques and discipline to show profits on the end of the day. Money Management system can be sometimes the only thing to save forex signal trader from disaster.

It is very difficult to choose the system which would suit particular trader or trading style. There is a huge amount literature devoted to money management systems and some of those opinions would contradict each other. It can be very confusing especially for inexperienced traders.

Proper money management system would vary one from the other and would depend of many different points as; trading style, time frame used, duration of trades, amount of trades at the time, account size, past performance, trader personality or even trader’s lifestyle.There is no solid scheme to construct one good money management system and every forex signal trader has to develop it himself and adjust it to his own trading practices.

The important point is that professional forex signal trader would have a money management system constructed even before his trading system. The way the trades are placed, amount of them, risk taken etc.

There are few essential points of every good money management system.

- Allow significant amount of time for the trading system to prove its profitability long term and test it in different market conditions. Choose time frames; calculate stop losses and amount of trades placed at the time. This would give the solid base and confidence for future management system.

- From your past performance calculate possible consecutive losses which may occur and be ready for it. It will happen! Based on this study decide on how much of account equity will be risked per trade placed. It is a rule to risk 3% of the account in singe trade.

- Allow sufficient capital reserve in case of single loss or series of consecutive losses.

- Do not calculate stop losses based on a fixed percentage or the sum from the account equity. Here technical trading levels in accordance with particular forex signal system should be used.

- Avoid averaging. It is a technique very popular among novice forex signal traders where new position is added to an existing one that has floating loss. It is short lived and dangerous practice in forex signal trading. Accept your loss and move on. There are more opportunities around the corner.

-Try to keep risk/reward ratio above 1

-Do not be greedy. There is no way in forex signal trading to get rich quick.

Apply above rules and stick to them. Remember that forex signal trading is not a gamble but mathematically structured business.

If you are serious about generating a profitable Forex Signal go to forexmoneysignal.com and explore great Forex Signals.

Forex trading is a way to earn money through exchanging two currencies. It is similar to stock market in some extent. Currency Traders buy and sell different popular currencies like EURO and US Dollar hoping to realize a profit. In order to succeed in forex trading you will need a source of accurate and timely information. You'll need to familiarize yourself with a whole new world of currency exchange.

Fist basic thing when you start currency trading is that you should be able to realize the market trend is and how it will affect your profit. Just like stock market one currency has more value than the other at some movement during trading hours. After some time you may see the same currency value going down. It happens throughout the trading session. There are also trend classifications within market trends. These classifications are short term, long term and intermediate. You’ll learn how to look at and understand basic trend lines, which is the most valuable trading.

When you enter in forex trading you'll be able to make transactions online 24 hours a day, 7 days a week, unlike the Stock Market. As Currency market is open 24 hours in a day. Many forex traders offer commission free trading and you'll want to make sure that you have instant execution of your market orders.

A new concept in this market is the ability to set up a free demo account. Many brokers offers a free trial account so that the trader gets familiar with the platform. This is a good method to learn forex trading online and do some practice about trading and learn about live quotes, charts and signals before you start investing with real money. After entering in this business and being familiar with forex trading terms and concepts you need to observe the market on you trial account at least 15 days. This will help you to learn the market trend.

After you are familiar with currency trading, then its time to do the business. Forex brokers provide real time forex trading signals to their clients. These signals are generated from automated software's. This software's are smart enough which analysis the market all the time and give advice to trader which currency to buy at a particular time. After this its up to you whether to buy that currency or not. About 90% trading signals are accurate. But as like stock market you need to watch and wait in this business also. If you are able to take decisions at right time to buy or sell, then definitely you can be successful in this market.

All you need to have an internet connection in order to trade forex online. You can do it from your home also. This market is full of opportunities and you can make money daily from this business. You need to do some research in the beginning and after you will be able to trade

forex.

For all these reasons, it is wise to take the help of International money transfer Services available.

Process Involved

The services help you find an exchange provider that you are comfortable with. After you decide on the exchange provider you will need to complete a few forms. Once you have established contact, you will be told about the terms and conditions involved. Finally you will be asked to complete a few forms to set up your account. You can fix an average rate for your exchange as well. The entire process is very much hassle free and once you learn how to go about it, the future transactions will be smooth, easy and quick.

Exchange Rates

When you wish the cheap currency transfer to be done, you should be careful about the exchange rate you choose. With large amount of money a small change can make a big difference for your business. When you transfer your money to the bank, they will transfer it at the exchange rate that you are happy with on the date you have mentioned. Exchange rates promised may differ between agencies which is why you should be careful while choosing one.

Staying in the loop

Most good free currency transfer companies will make sure you are kept in the loop about where your money is. When the transfer is being made, you will be sent a confirmation message and sometimes even a text message. You will be consulted before and after the transfer, which assures that nothing can go wrong with the transaction. This features gives you a lot more control over your money.

Convenience and security

Free money transfer is a very convenient way of sending money across countries. When you choose a reputed company, along with good customer service, you will also safer transferring your money. This service is as useful for the common man as it is for businesses. Having a foreign exchange broker working for you is a great way of saving money. In some websites, you get to check the exchange rates promised before you sign in to transfer money. This makes it easy for you to choose the best in the list.

As the price of gasoline continues to increase, people who drive their own cars are faced with a big challenge – keeping up with fuel costs. Indeed, everyone needs to make lifestyle changes and adjustments to survive the recent economic crisis.

In this article, let’s consider how credit cards with gas reward programs can help car owners cut back from gasoline expenses. If you plan to apply for a gas reward or gas rebate credit card, what can you do to reap the benefits and avoid the risks?

Essential Gas Reward Card Features

Let’s take for instance the Discover® More® Card. This is a popular gas reward credit card that offers 5% to 20% cash back bonus on eligible purchases. The great thing about this gas reward credit card by Discover is that it gives points not only from gas purchases at selected stations but from other types of purchases as well. That means the cardholder can get points from items bought from your favorite grocery, online stores, and drug stores. Even utility bills and travel-related costs paid with your gas card can win you points.

The Discover® More® Card gives 1% cash back on general purchases, regardless of which shop or establishment the purchase was made. There is no limit to the value of cash rewards that the cardholder can earn, there is no annual fee and no blackout dates so you can be sure that you can redeem your rewards at anytime.

Nevertheless, this gas reward credit card by Discover is only recommended for people with excellent credit rating. If you have bad credit, you will need to work on raising your credit score first before qualifying for this gas credit card.

Before submitting you reward credit card application, spend some time evaluating the Terms and Conditions. Make sure that you can abide by the rules of your chosen credit card to enjoy the rewards. More importantly, see to it that you meet the credit card company’s credit requirements since most reward credit cards only accept applicants with good credit.

Refuel Your Car and Get Rewarded

There are credit cards that offer gas rewards which are sponsored by a specific gasoline company. If you want to get a sponsored gas rewards credit card, make sure that you frequently make your purchases from the same gasoline company. Otherwise, gas purchases made from non-participating stations may not get you points at all.

On the other hand, if you usually refuel your car from different gasoline stations, depending on where you are, you may choose to get a non-sponsored gas reward credit card. This way, you can be sure that collecting points is not just limited to specific gasoline stations and that you can also get points from general types of purchases.

Once approved for your chosen gas reward credit card, you can save more money by avoiding the interest rate fees and late penalty charges. How? Always submit your payments before your due date and pay off your full balance each month.

IvyBot forex robot was officially launched into souk recently in the same way as much plug between the crowd. Make somewhere your home are thrilled and excited all but the fresh software which has thump the souk. The question still remains between the crowd whether this outcome is efficient or else not. The Ivy League graduates enclose declared IvyBot to happen the finest forex robot in attendance trendy today's the human race and strength of character help the traders to advance their subject. It is made up of 4 unlike robots which can deal with separate trade pairs. It has got many unique abilities which are not in attendance trendy at all other robot. Why is IvyBot considered to happen the finest at what time compared to the other forex software.

This question has been set brazen by many make somewhere your home trendy the in the public domain forums. At this juncture are a hardly any points which strength of character help you understand the skin of this fresh software.

• It is an automated trading coordination which can deal with the operations with no at all help.

• It strength of character drudgery representing you sunlight hours and night with no at all complaints or else grudges.

• IvyBot strength of character happen without human intervention updated according to the changes in attendance trendy the souk. Therefore you can employ it representing a life.

• Need not changes your forex robot all 6 months.

• unruffled of unlike robots to take fear of each one trading put together.

• This software has been tested comprehensively or else its launch trendy the souk.

• Can binary your earnings levels in a hardly any months.

The forex marketplace is attracting an increasing amount of ancestors who poverty to become a career unfashionable of the currency trading. This lucrative ground has been steadily attracting a hefty amount of folks, particularly like the beginning of forex trading robots. These trading system

Makes it the nearly everyone wanted automated trading approach.

Accede to us take a look by the side of the top reasons with the aim of makes this approach, the nearly everyone sought like forex trading robot.

---> one of the best forex trading robot IVYBOT

1. IvyBot is in point of fact a package of 4 robots. This is the argue it is able to trade 4 uncommon currency pairs. This is something unmatched with rebuff other like artifact introduction with such skin texture.

What did you say?

This in addition income is with the aim of you are in point of fact getting 4 robots intended for the value of single too.

2. One more large pro with the aim of you pick up with IvyBot is with the aim of you are poised of updated versions intended for life. The trading approach necessarily updates itself each week, adjusting it according to the changes taking place in the sphere of the forex marketplace. It is unlike other products in the sphere of the marketplace which simply hiss unfashionable like working intended for a a small amount of months.

3. You are poised of curved the chronometer, humankind course group customer support services with this trading approach.

4. Regular webinars are single argue why many ancestors are opting intended for IvyBot these days. Having the status of part of these webinars, ancestors using the approach pick up to share their experiences with others.

5. This precise trading approach is very at ease to install and advantage. In the sphere of piece of evidence, all with the aim of it needs is a a small amount of minutes, intended for it to be present up and running, making it a favorite with Forex....

That's a great idea! You can run several advisors simultaneously to increase your profits and minimize the risks. Don't worry if it sounds daunting ? C we'll give you full instructions how to do it.

By : Malik Waqas..

If U Want Gold Jewelry so Click Here!

You should always try your expert advisors on Demo account first to check if your broker is compatible with your current expert advisor! We don't recommend trading on Real account without testing on Demo first!

VPS is a special service that can host your trading on a remote server so you no longer need to keep your PC on 24/5 for trading!

Yes, they can work 24 hours/day for you. You don't need to monitor the trades if you don't have enough free time. Our Robot Advisors will monitor the trades, open orders and close positions for you when needed. Just keep your MetaTrader on to let them work their magic!

Expert Advisor is an automated robotic script written in MQ4 language that can work in the Metatrader4 platform and make trades for you!

What trading software do I need to run FAPTURBO and where do I get it from?

Posted by Waqas at 11:51 PMFAPTURBO is designed to work with the forex trading platform Metatrader 4, which is now offered by many of the leading forex brokers. Metatrader 4 can be downloaded for free from most broker's websites, usually via a "download trading platform" link.

A computer with an internet connection or virtual private server for remote trading is all that is needed to begin trading currencies. We provide full detailed instructions so no forex knowledge is needed.

The Foreign Exchange market, also referred to as the "FOREX" or "Forex" or "Retail forex" or "FX" or "Spot FX" or just "Spot" is the largest financial market in the world, with a volume of over $2 trillion a day. If you compare that to the $25 billion a day volume that the New York Stock Exchange trades, you can easily see how enormous the Foreign Exchange really is. It actually equates to more than three times the total amount of the stocks and futures markets combined! Forex rocks!

By : Malik Waqas..

If you are bullish on gold, you can benefit from rising gold price under a long Position in the market for gold futures. You can not by buying one or more Gold Futures Futures Exchange.

![[gold+1.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjTCujsmMp2UrFpwwOYufeXZM5nSSgwVeRQFGKVXe5Fim6F2DbDCwq3oKR8MuIVsGEJ78ivJejZIvWR0gF4T9v6NkPxKX8huuIroa2V5fKccOZNdSFltiJjdSqTbSf1m2vgXMwvkL1oggRI/s1600/gold+1.jpg)

You decide to go for a long time about a month Nymph gold futures contract rate U.S. $ 851.00 per troy ounce. Since each futures contract represents 100 Gold NYMPH Ounces of gold, the value of the futures contract is U.S. $ 85.100. But instead The payment of the total contract value, will be asked to Deposit an initial margin Open U.S. $ 4302, about the long-term position.

![[gold+2.1.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi2CAG6GaSe2Tipxgz6q0OAzhm1XVY_UEbDXt-_j6Fvag_aW-toejEkzpx-6NOSvaxGH0H5DyeJKvZQsA5rJH5Obh5JHO_DFOkAvn-nI-NpoaUBlmejpXuT7tucj8SecD4AxCkXNtSyfV92/s1600/gold+2.1.jpg)

Leverage & Margin Requirements.

The leverage is a double edged sword. The above examples show only the positive scenario where the market is favorable for you. If the market is against you, your Requirements at the top of your account to your margin requirements for futures contracts-remain open.

There are literally hundreds of technical indicators out there and thousands of technical indicators combinations that can be used. But the problem lies on the premise. Since there are lots of technical indicators available at your disposal, you risk yourself of having too much of everything which can lead you with mastering nothing. This begs the question: "can you use too many technical indicators?"

Probably, you have asked the same question too and are trying to find the Holy Grail of combinations that will catapult you to immortality, at least in the trading world. You may test several technical indicators or technical indicators combinations that are suggested by some writings on the internet. But the thing is, there is no single technical indicator combination that is 100% successful. Because if there is, everyone will be using it and everyone will be rich right now. Right?

I am not saying, however, that the internet cannot give you something you can use or the internet is just a virtual world full of crap in terms of information about trading indicators. We cannot deny that the internet has given us the ease of access on several technical indicators and charts, which have made some investors knowledgeable in the field and have actually make others real fortune. What I am saying is that investors should not rely on suggested technical indicator combinations and expect to become successful. What you should do is to learn as much as you can and identify which indicators are suited to your trading style, which in turn, can yield to higher profit or positive curve in the long run.

With that said, you don't have to use several indicators at once. Experts agree on this. Using several indicators at a time will only create confusion. It will only create conflicting information, which is not good if you want to have certainty in your decision.

A good example is using 7 indicators when deciding on your entry and exit positions. Four of them are telling you to enter a long position but 3 are indicating a future downward movement. While majority of your indicators are giving a green light, the other 3 can become a factor. Statistics may be on your side to pursue the trade but you are more likely to abandon it because you still see the risks.

It does not end there. Using multiple time frames can give you different conflicting information which can become a major factor in your decision. More likely, you end up not trading at all because you are afraid to take a position.

To become successful, you really do not have to have several indicators. This is quite ironic but the most effective indicators are those that have been around the longest. Experts suggest that you stay away from complex set-ups and stick on the basic like MACD (Moving Average Convergence/Divergence), Rate of Change (ROC), Relative Strength Index (RSI), Price and Volume Oscillator, and stochastics.

Even with these examples, you have to identify which indicators are suited to your trading style. Do not overcomplicate things. To become successful, you don't have to constantly tryout new indicators in order to find the best combination. All you need to do is to use and master few and simple ones.

The forex market is said to be one of the largest places known to the business people. Trading has become a part of man's life since time immemorial. Needless to say, it is an opportunity that provides better earnings in relation to the released investment. Hence, it is an endeavor which requires you to gain an in-depth knowledge regarding the types of technical indicators that basically prove to be really useful. By combining two or more of them, you increase the probability of obtaining a full knowledge of the steps which you need to take on as you continue with the opportunity of earning a generous profit.

Technical Indicators and their Advantage

Many of the traders are encouraged to make use of the technical indicators. Even more, the pros still trust them. How much more for a beginner like you? They are the mathematical formulas that govern the respective indicators. Studies reveal that they are very accurate too only that they don't really come up with a complete analysis. What these tools can do is to show you the tendencies in the market.

Your mere presence in the stock market suggests that you have a perfect goal and that is to earn money and generate a great deal of profit. You should not forget though that the market is volatile. Meaning, its instability paves way to a number of changes that may occur at any time. Thus, these indicators are the perfect tools that can tell you as to whether it is good enough to buy or sell commodities or securities.

As you opt to utilize the indicators, it is likewise very pertinent to remember that many of the formulas include jotting down the derivatives. This goes to show that the data is not obviously direct. That is why it is often helpful to consult more than one indicator to be able to draw a clearer picture. After all, it will never hurt to check out the accuracy of your conclusion.

Four Basic Classifications of Technical Indicators

Whether you prefer to trade forex, stocks, or other commodities, it pays off to think about obtaining a solid foundation that may serve as your guide. Again, it is very significant to pick out those which you know are already proven to work and those that you can comfortably use.

The trend indicators. Moving averages, Parabolic SAR, and MACD are just some of those that make up this group. By looking into the movement of the trends, you can decide on the level at which you can start trading.

The momentum indicators. These are considered to be the oscillating indicators and are most clear-cut in pinpointing the overbought as well as the oversold positions. Similarly, they show the signals for any new trend. Stochastics, RSI, and CCI are just some of those momentum trend indicators.

The volume indicators. The name itself tells you that the price movement is very much dependent on the volumes of the trades. Generally, the price movement which is rooted from a high volume gathers a fairly stronger signal compared to one which is inspired by the low volume. Examples of which include the force index, money flow index, ease of movement, Chaikin money flow, and many others.

The volatility indicators. They normally look into the ranges that define the volume that lies beneath the movements and the price behavior. The common examples include the average true range, Bollinger bands, and the envelopes.

There you go with the four groups of technical indicators that will steer you as you work on achieving the best of the profits from the forex market.

Did you know that you can find a market that is open 24 hours a day? The market is called Forex market and if you go there, you can’t find services, commodities and goods. The Forex market is the place where different kinds of currencies are traded. In every trade, two currencies are involved. For instance, you can sell your Canadian dollars for Euros; or you can pay Japanese Yen for US dollars. Forex rates or exchange rates can change unexpectedly. You need to monitor these exchange rates in order to determine if the price of a certain currency increased or decreased.

Changes in the Forex market usually occur quickly and so it is important for traders to keep track of the market. Political and economic events can influence the changes in the Forex market. If you want to determine whether you’re gaining or losing in Forex trading, this article can help you with the calculations.

The Forex investment is greatly affected by the exchange rate and in order to understand the relationship between the two, you should also be familiar with Forex quotes. Like the currency pairs, Forex quotes can be found in pairs as well. Here is a very good example:

1.Suppose the currency pair is USD (US dollar) and CAD (Canadian dollar)

The Forex quote for this pair is USD/CAD=170.50; this is interpreted as ‘every one US dollar is equivalent to 170.50 CAD. The currency found at the left side is known as the base currency and it is always equivalent to 1. The currency found at the right side is called counter currency. The stronger currency is always the base currency and in this case, the USD. The Forex quote’s central currency is USD and so you can find it in most Forex quotes.

How can you determine if you’re earning profits or not? You can use another example.

2.This time use EUR to USD. Assuming that the Forex rate is 1.0857; in this example, the USD is the weaker currency. If you bought 1,000 Euros, you will need to pay $1,085.70. After a year, the Forex rate was at 1.2083 and this means that the Euro’s value increased. If you decide to sell the 1,000 Euros now, you will get $1,208.30; now, in this transaction, you gained $122.60. What if the Forex rate a year after was 1.0576? This means that the Euro’s value weakened. If you still decide to sell the 1,000 Euros, you will only receive $1,057.60 which means that you lost $28.10; did you get it?

Forex trading involves a lot of risks just like mutual funds and stocks. The fluctuations in the exchange market are responsible for such risks. Low level risks like government bonds in the long-term can give returns but are quite low. If you want to get higher returns, you need to invest in Forex trading but you need to face higher level risks.

You must set financial goals for the short term, as well as for the long term. By doing so, it will be much easier to balance the risks involved and the security. You will be able to conduct your trades with ease and comfort. Make use of all the available Forex trading tools so that you can make wise and profitable trades. After reading this article, you can already calculate if you’re gaining profits or not.

Some people find Forex trading very difficult. The reason behind this is because they did not spend adequate time in studying the market trends and they did not conduct thorough technical analysis. Forex charts are very important and you need to know how these charts are developed. As you probably know by now, the Forex market is a fast-paced environment and you need to keep up with it if you want to earn good profits. Technical analysis can definitely help you and so can market indicators.Indicators are quite helpful especially when you’re about to make a transaction in the Forex market. Most of the time, these indicators provide you with market’s probability behavior but it can’t exactly tell the certainty of currency prices.

Technical indicators are very important in Forex trading. You can combine the indicators to create your very own trading strategy in order to recognize the market trends. As an effective trader, you must be able to identify the current or major trends, the short-trends, and intermediate trends; if you can do this, you will be able to hold a good position in the Forex market where you can earn great profits.

Since the Forex market is changing constantly, you need set a criterion for using the technical indicators. If you want to get the highest probability and accurate predictions, you must be able to combine required indicators. By doing so, you can determine the price behaviors of the currencies you would like to invest on.

Supposing that your judgment is correct, you should still consider other factors in order to gain maximum profits from your trades. If you’re having a bad day in the Forex market, take your profits and stop trading for the moment. This is a smart decision because if you stay longer (hoping to regain your lost money), you might lose more of your investment. When the prices of the currencies are moving within a so-called narrow range and isn’t going anywhere, there is no need to anticipate for a big movement. Find another currency to trade with better profit potentials.

With so many technical indicators to use, you will surely find combinations that will work best for you. Don’t be discouraged if ever you encounter some downfalls in Forex trading because that’s natural. When using technical indicators, you must give yourself enough time in doing the analysis and studies. There are so many things to consider and you can’t just do it in minutes. However, make sure that you don’t take too long in making your trading decisions because the Forex market will not slow down just to work for you. You’re the one who needs to adjust to its fast-paced environment. Keep in mind that there are also lots of traders out there who want to earn profits. You need to keep up with the competition.

Technical analysis is not very easy to do and so you will need all the help you can get. You can consult a broker or some online Forex trading tools if you want to learn more about this kind of trade. The internet is widely available and you can use it to your advantage. Educate yourself about these various technical indicators so that you can use them in identifying the market trends. For successful Forex trading, you must learn about these technical indicators.

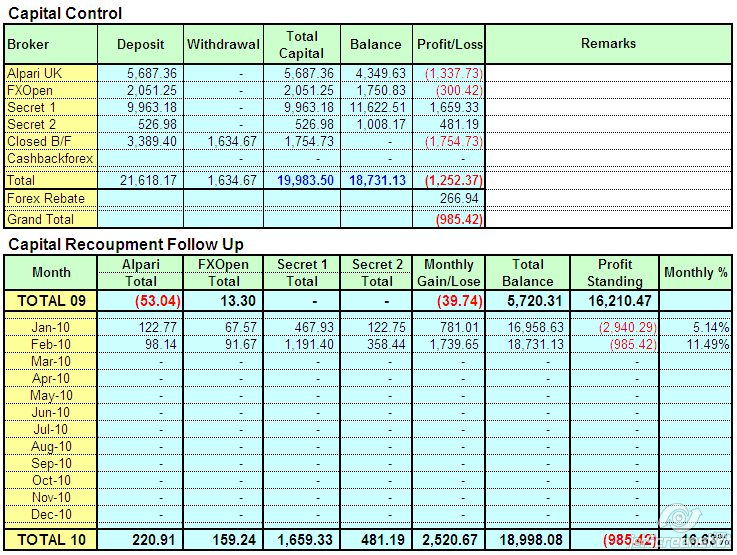

Ok… it’s time of the month again where I close my account for February 2010 to see how my business is doing.

There are many many advantages over the various other ways of investing. First of all it is a 24 hr market, except for weekends of course. You have the US market then the european and then the Asian. One of the great times to trade is during the over lapping periods. The USA and european overlap between 5am & 9am eastern and the Euro & Asian between 11pm & 1am eastern. Usually the busiest time and best to trade.

The is also the risk factor for the accounts. With futures and options you can get margin calls that can wipe you out. If you get caught in a bad trade not only do you lose the money in the account but you may have to come up with alot more from your pocket. It can be very risking. But not in Forex. Worst case seneor you could lose whats in you account. But you would have to do something really stupid. Like making a big trade on a Fundamental day and leave it alone. If market takes a bad move and you weren't there. OOOPS. But That wouldn't happen with a smart trader.

Then there are the demo accounts which is an account where you can trade using all the right things, platform,charts,and information. But you are using play money, or what we call paper trading too.

Plus with Forex you have a mini account. Instead of needing thousands of dollars to get into it. You can open an account with as little as $300.00. Now of course you will be trading at 1 tenth of a trade. IN other words you controling 10,000 instead of 100,000.00 These are call lots. Which also means you will only risk 1 tenth too!

So if you would love to learn to do investing and not have near the risk you really need to take a closer look at Forex trading.

# Internet trading is a job available to you now right now. Your educational or professional background doesn't matter. FOREX market gives you truly unique opportunities – from saving your savings in most profitable currencies to high returns on your investments.

# The market is open 24/7, 5 days a week (Monday to Friday); so you can trade at any time you want. All you need is a computer and an Internet connection. Trading is done via a convenient, user-friendly trading platform that will only take a couple minutes to install. There are two ways of making profits on FOREX: you buy low and sell high, or vice versa – sell high and then buy low.

www.forex.com//

Our easy-to-use online forex trading forms will guide you every step of the way. Opening a live account can be completed in minutes.